A Universal Life Insurance Policy Is Best Described as Quizlet

All groups and messages. Start studying Universal Life Insurance.

Exempt from federal income tax.

. C Flexible Premium Variable Life policy. A Prevent the beneficiarys reckless spending of the death benefit. Learn vocabulary terms and more with flashcards games and other study tools.

B Whole Life policy with two premiums. Rob purchased a standard whole life policy with a 500000 death benefit when we was age 30. An Annually Renewable Term policy with a cash value account.

D Annually Renewable Term policy with a cash value account. M purchases a 70000 Life Insurance Policy with premium payments of 550 a year for the first 5 years. Rob recently died at age 60.

A Universal Life Insurance policy is best described as aan a Variable Life with a cash value account. Subject to the cost recovery rule. Can purchase extended term of coverage for a period of two years or more.

The face amount will remain at 70000 throughout the life of the policy. A provision for a secondary beneficiary. He dies in a freak accident on June 1.

An annually renewable term policy with a cash value account. Subject to the value added. The insurer can make policy charges without difficulty.

C Pay the death benefit in fixed-amount or fixed-period payments. His insurance agent told him the policy would be paid up if he reached age 100. Selling variable universal life insurance policies as mutual funds is an example of a prohibited practicecalled A.

An employee quits her job on May 15 and doesnt convert his group life policy to an individual policy for 2 weeks. Variable survivorship life insurance is a type of variable life insurance policy that covers two individuals and pays a death benefit to a beneficiary only after both people have died. All of the following are characteristics of a Universal Life policy EXCEPT.

B Whole Life policy with two premiums. Indexed or fixed universal life policies. Universal life UL insurance is permanent life insurance with an investment savings component.

An advantage of owning a flexible premium life insurance policy would be. A guide to the pros and cons of universal life insurance and how it compares to other life insurance policies. The present cash value of the policy equals 250000.

Some life insurance policies such as whole life or universal life build equity as you pay premiums. A Modified Endowment Contract MEC is best described as A life insurance contract which accumulates cash values higher than the IRS will allow An annuity contract which was converted from a life insurance contract A modified life contract which enjoys all the tax advantages of whole life insurance A life insurance contract where all withdrawals prior to age 65 are subject. A Universal Life Insurance policy is best described as aan a Variable Life with a cash value account.

A Universal Life Insurance policy is best described as. Until the policy owners age 100 when the policy matures. Subsequently question is what is survivorship life insurance.

This particular policy may be paid up when the cash value plus accumulated dividends a. A universal life insurance policy is best described as. B Allow the beneficiary to change to another option when insured dies.

The premiums are flexible but not necessarily as low as term life insurance. The planned premium pays for mortality charges and expenses and any excess is returned to the policy owner. A combined investment plan and insurance policy.

The death benefit would be. 20211013 Insurance 單詞卡 Quizlet 1012 These are all accurate statements regarding universal life insurance EXCEPT Mortality charge is deducted from the policys cash value each month Policy loans are not permitted Flexible premiums as long as the cost of insurance protection is covered Policy states what percentage of the premium is contributed to the cash. Under a 20-pay whole life policy in order for the policy to pay the death benefit to a beneficiary the premiums must be paid.

When values of an insurance policy are used to purchase another policy with the same insurer for thesole purpose of earning additional premiums or. Scott has a life insurance policy in which the dividends are left with the insurance company. Universal life insurance is.

Primarily sold to college students. Until the policy owner reaches age 65. For 20 years or until death whichever occurs first.

Target and minimum. Equal the net single premium for the same face amount at the insureds attained age b. Premiums are fixed for the first 5 years.

A deferred premium payment policy. A universal life insurance policy is best described as. Less expensive than other policy types.

Subject to attachments from the insureds creditors. The Spendthrift Clause of a life insurance policy is designed to do all of the following EXCEPT. At the beginning of the sixth year the premium will increase to 800 per year but will remain level thereafter.

The policy owner can make policy changes without difficulty. A universal life insurance policy is best described as. Death benefits from a life insurance policy are normally considered to be.

Exempt from federal income tax. Many companies featured on money advertise with us.

Chapter 8 Types Of Life Insurance Policy Flashcards Quizlet

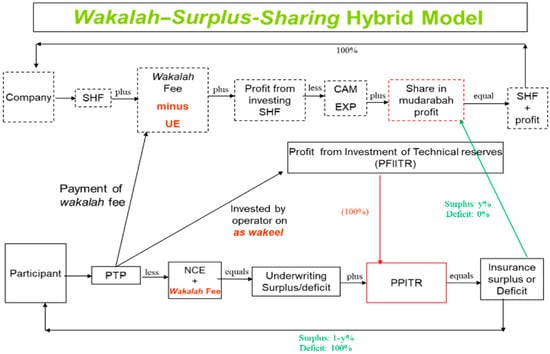

Jrfm Free Full Text A Nontechnical Guide On Optimal Incentives For Islamic Insurance Operators Html

Fast Payday Loans Marianna All Credits Are Welcomed Payday Loans Online Easy Payday Loans Payday Loans

Rakib On Twitter Debt Consolidation Loans Loans For Bad Credit Payday Loans

Pictorial Representation Of Cancer Types Examined In Individual Download Scientific Diagram

Level Premium Term Life Insurance Policies Quizlet At Level

Level Premium Term Life Insurance Policies Quizlet At Level

Maximise Your Visit To Adventure Cove Waterpark Singapore Singapore Travel Water Theme Park Travel Destinations Asia

Term Vs Whole Life Insurance Which Is Right For You The Budget Mom Life Insurance Agent Life Insurance Facts Life Insurance Marketing

What Should You Consider Before You Buy Life Insurance Quizlet How To Buy Car Insurance In F Life Insurance Facts Dental Insurance Plans Buy Health Insurance

What Should You Consider Before You Buy Life Insurance Quizlet How To Buy Car Insurance In F Life Insurance Facts Dental Insurance Plans Buy Health Insurance

Common Health Insurance Terms Healthnetwork Blog Health Insurance Infographic Dental Insurance Health Insurance Quote

What Should You Consider Before You Buy Life Insurance Quizlet How To Buy Car Insurance In F Life Insurance Facts Dental Insurance Plans Buy Health Insurance

Merek Jok Mobil Yang Berkualitas Car Seat Sarung Jok Mobil Mobil

Life Insurance Policies Provisions Options And Riders Part 1 Flashcards Quizlet

Comments

Post a Comment